What is AML Software?

Anti-money laundering (AML) software is used in the financial and related sectors that need to comply with the tightening legislation imposed by regulatory bodies. It can prevent or detect anomalous activity, reduce false positives, and assist companies in an accurate reporting of suspicious transactions.

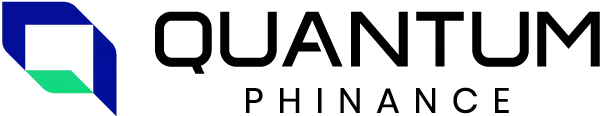

Why do finance organizations need AML software?

- Increased criminal threat level

- Pressure from regulatory bodies

- Unsustainable costs

- Existing methods are struggling

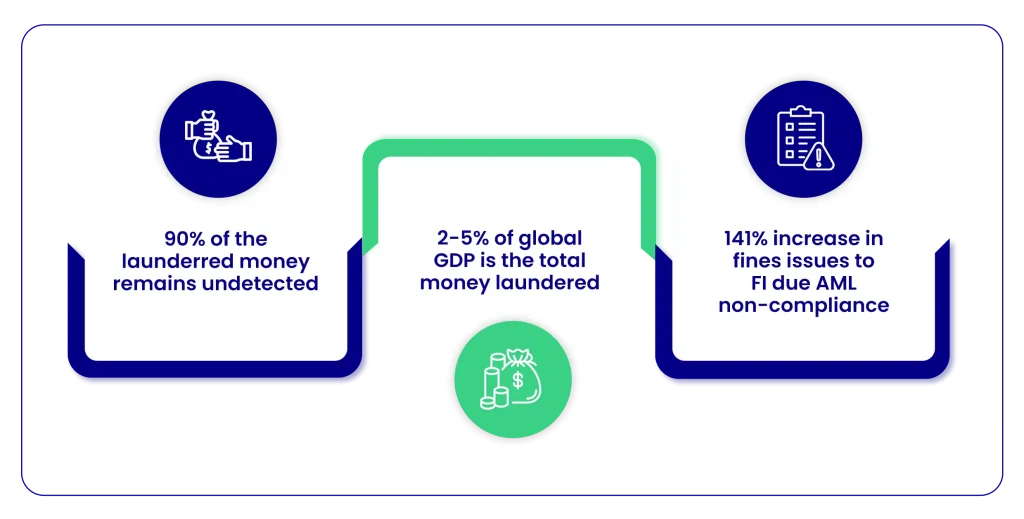

One solution for all your AML needs

Our world class platform helps you identify individuals and entities by monitoring, investigating, and reporting any potentially suspicious transactions and activities by computing their respective Risk Score.

- Our Platform creates various pre-configured rules known as ‘Criteria’ that help us monitor transactions in real-time.

- All the transactions are sent to SheetKraft’s engine where they are reviewed against the Criteria to look for suspicious transactions.

- Once reviewed, transactions are flagged if they trigger any one of the Criteria.

- Depending on the number of criteria triggered, a transaction is segregated into scenarios that have a respective Risk Score.

- The Risk score then determines the action to be taken for that transaction.

Our methodology

Multiple branch transactions and their count –

- A criteria is triggered when a transaction of 500 million is made from a customer account.

- May or may not be from a single branch.

- Is compared to the previous day’s normalized account.

- If the total no. of transactions is => 5, then another criteria is triggered.

- Individually, the criteria have a zero score.

- But if both are set-off together, then the transaction is parked in a Scenario Block.

- In this case, Scenario Block – 4.

- The Scenario Block – 4 has a Risk Score of 300.

- Hence the said transaction falls under Risk Level 3.

- Appropriate action taken for each Risk Level.

Different Criteria sets can be specified to various requirements as well as compliance standards. Alarms / Triggers can also be defined as low, medium, high, and critical according to the respective Risk scores.

The result

An end-to-end application that leverages a robust data model and comprehensive analysis to deliver a single transparent, holistic view of all financial crime and compliance-related activities across the enterprise.